Money’s Role in Reducing Transaction Costs and Promoting Efficiency

Money plays a crucial role in our daily lives, enabling us to facilitate transactions and exchange goods and services. One of the essential functions of money is to reduce transaction costs and promote efficiency in the economy. In this article, we will explore how money achieves this and why it is vital for economic growth.

What are transaction costs?

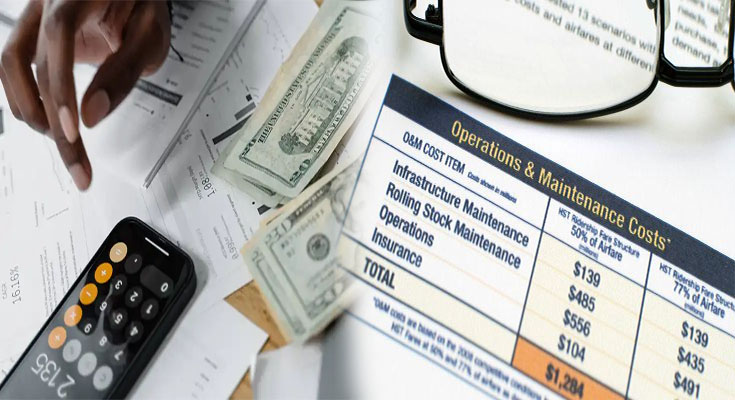

Transaction costs refer to the expenses incurred when buying or selling goods, services, or assets. These costs include fees, commissions, paperwork, transportation, and any other expenses associated with the exchange. Transaction costs can be both monetary and non-monetary, and they can hinder economic activity by slowing down transactions and reducing efficiency.

Liquidity and reduced transaction costs

Money is a medium of exchange that provides liquidity, making it easier to buy and sell goods and services. By using money as a means of payment, individuals and businesses can eliminate the complexities and …

Money’s Role in Reducing Transaction Costs and Promoting Efficiency Read More