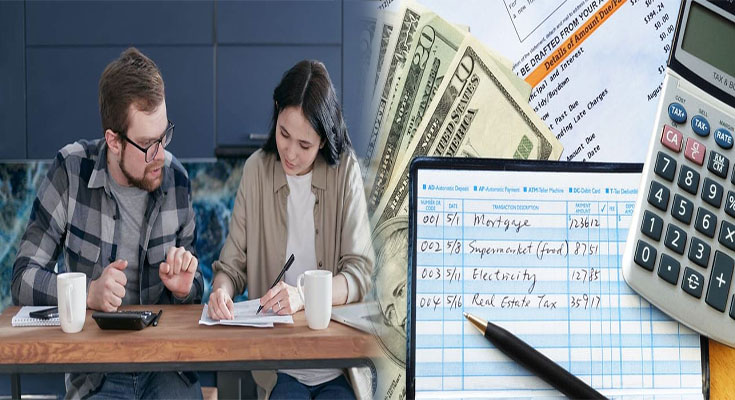

Strategies for Sticking to Your Household Budget Goals

Creating a household budget is a crucial step towards managing your finances and achieving your financial goals. However, sticking to your budget can often be challenging, as unexpected expenses and temptations arise. To ensure success in adhering to your household budget, it is essential to have effective strategies in place. In this article, we will explore some strategies to help you stay on track with your budget goals.

1. Set Realistic Goals:

- Start by setting realistic budget goals that align with your financial situation and lifestyle. Set specific targets for saving, debt repayment, and spending. Be practical and considerate of unexpected expenses, emergencies, and occasional splurges.

2. Track Income and Expenses:

- Keep a meticulous record of your income and expenses. Regularly track and categorize your spending to identify areas where you can make adjustments. Several budgeting apps and online tools can assist in simplifying this process.