The Role of Lending Institutions in Shaping Economic Cycles

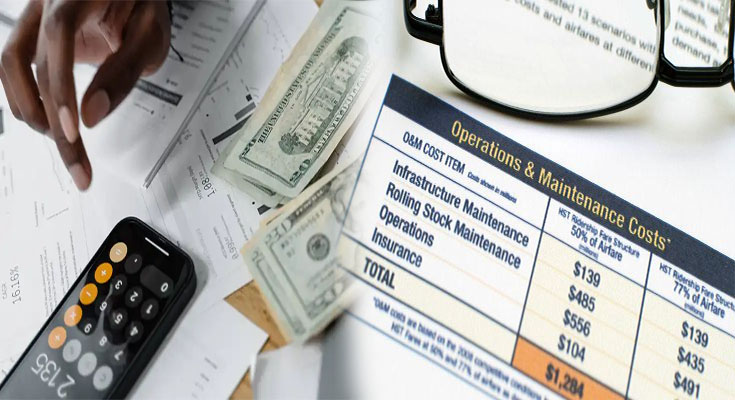

Lending institutions play a crucial role in shaping economic cycles, both during periods of expansion and contraction. These institutions, which include banks, credit unions, and other financial intermediaries, provide essential financial support to businesses and individuals, influencing the overall state of the economy. In this article, we will explore their role and impact in shaping economic cycles.

Role in Expansions

During economic expansions, lending institutions fuel growth by providing funds to businesses and individuals. They help facilitate investment projects, expand business operations, and enable individuals to make purchases such as homes and cars. By providing capital to the economy, these institutions stimulate economic activity and create jobs, thus contributing to the overall prosperity of the nation.

When lending institutions lower interest rates during an expansionary phase, borrowing becomes more affordable. As a result, businesses and individuals are encouraged to take loans and invest in productive activities. This increased spending creates …

The Role of Lending Institutions in Shaping Economic Cycles Read More