Secured Loan Options for Online Bad Credit Applicants

Having a bad credit history can make it challenging to obtain a loan, especially through traditional financial institutions. However, there are secured loan options available for online applicants with bad credit. Secured loans allow borrowers to use collateral to secure the loan and increase their chances of approval. In this article, we will explore some secured loan options that are accessible to individuals with bad credit and can be obtained through online platforms.

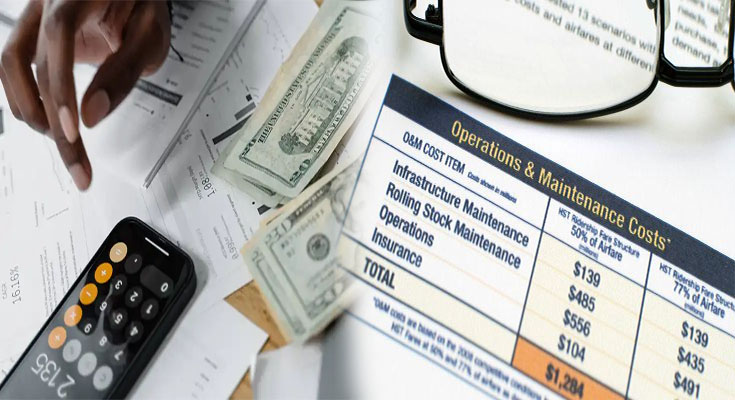

Understanding Secured Loans

Secured loans are loans that are backed by collateral, such as a vehicle, real estate, or other valuable assets. Unlike unsecured loans, which rely solely on the borrower’s creditworthiness, secured loans provide lenders with a form of security in case the borrower defaults on their loan payments. This collateral reduces the risk for lenders, making it more likely for individuals with bad credit to be approved.

Home Equity Loans or Lines of Credit

One popular secured loan option for homeowners with bad credit is a home equity loan or line of credit (HELOC). These loans use the borrower’s home as collateral, providing lenders with a sense of security. Home equity loans or HELOCs are typically based on the amount of equity the borrower has …

Secured Loan Options for Online Bad Credit Applicants Read More